Debt Relief Programs

If you’re feeling overwhelmed by debt in Missouri, you’re not alone. From St. Louis and Kansas City to Springfield, Columbia, and smaller towns across the state, thousands of Missourians are struggling with credit card debt, medical bills, and student loans. At APFSC, we offer tailored, non-profit debt relief and credit counseling services to help you pay down your debt and regain control of your finances—without taking on more.

The Growing Debt Problem

Debt in the Show-Me State

Although Missouri has a relatively moderate cost of living, many residents still face financial stress due to stagnant wages, inflation, or sudden life changes. The average credit card debt per borrower is over $5,600, while the average student loan debt in Missouri exceeds $32,000. Roughly 11.9% of Missourians carry student loan balances, many of whom are struggling with repayment.

Whether it’s a medical emergency, job loss, or ongoing reliance on credit to cover everyday costs, debt can escalate quickly. When minimum payments barely reduce the balance, it’s time for a structured solution—and that’s where APFSC steps in.

How APFSC Helps Missouri Residents Pay Off Debt

Our process begins with a free consultation with one of our certified credit counselors. After reviewing your income, expenses, and total debts, we’ll build a personalized Debt Management Plan (DMP) that consolidates your unsecured debts into one affordable monthly payment—usually with lower interest rates.

Benefits of a DMP include:

- One monthly payment that fits your budget

- Reduced interest rates negotiated with your creditors

- Waived late fees and fewer collection calls

- A clear payoff timeline of 3 to 5 years

- Access to budgeting tools and long-term financial education

A DMP is not a loan. It’s a smarter way to pay down your current debt—with structure, support, and savings.

Why Missourians Fall Into Debt

- High medical bills with limited insurance coverage

- Unstable income from farming, hospitality, or retail jobs

- Credit card use to cover housing and transportation

- Student loan repayment burdens after graduation

- Limited emergency savings for unexpected expenses

Talk to a HUD-certified housing counselor to get help with the housing challenges you’re facing.

What Is a Debt Management Plan?

A Debt Management Plan offers a structured way to repay unsecured debts like credit cards, personal loans, and medical bills. Once enrolled, you’ll make one monthly payment to APFSC, and we’ll disburse payments to your creditors—often with reduced interest and improved terms.

Advantages of a DMP:

- Lower interest = lower total repayment

- Simplified monthly payments

- End to collection harassment and threats

- Potential credit improvement over time

- Full support from certified financial counselors

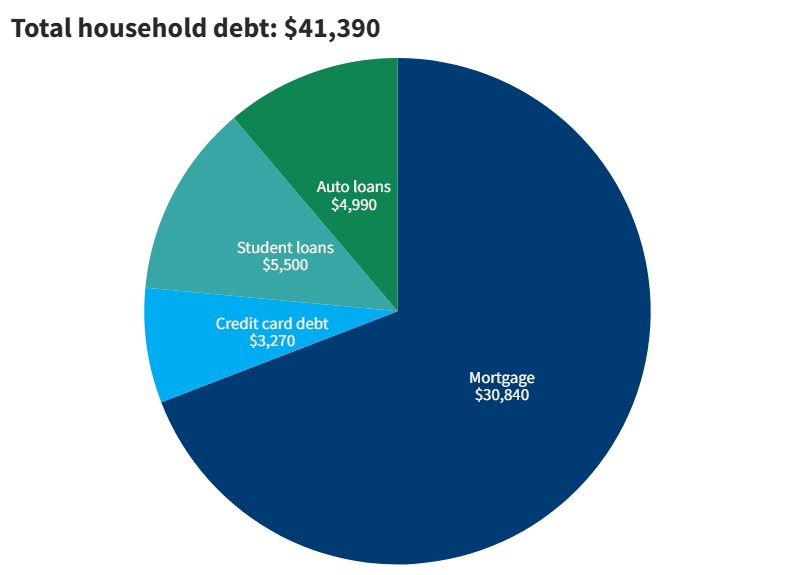

Missouri Debt Statistics

- Average credit card debt: $5,611

- Average student loan debt: $32,107

- Residents with student loans: 11.9%

- Total student loan debt in Missouri: $30.4 billion

- Average credit score in Missouri: 711

Why Missouri Residents Choose APFSC

As a highly trusted non-profit organization, APFSC is dedicated to helping people—not profiting off them. We don’t offer loans or sell quick fixes. Instead, we provide real solutions backed by education, empathy, and experience.

With APFSC, you receive:

- Individual support from certified credit counselors

- A custom repayment plan that works for you

- Direct negotiations with your creditors

- Tools to help manage your money and stay debt-free

- Encouragement and support throughout your journey

Thousands of Missouri have already trusted APFSC to help them become debt-free—and now it’s your turn.

Talk to a HUD-certified housing counselor to get help with the housing challenges you’re facing.

FAQ

Will a Debt Management Plan hurt my credit score?

Initially, it might dip slightly, but most clients see improvement over time as they make consistent on-time payments.

How long does the program take?

Most people complete their plan in 3 to 5 years, depending on how much they owe.

Can I still use my credit cards?

Once enrolled in a DMP, those accounts are typically closed to help you stay on track.

Is my information kept confidential?

Yes. All consultations and services are private and secure.